European authorities refuse to investigate apartheid's banks

- Lee-Anne Bruce

Authorities in Belgium & Luxembourg are refusing to investigate CALS' complaint detailing the role of European banks in supporting and profiting from apartheid

More than one year after submitting a complaint detailing the role of European banks in supporting and profiting from apartheid, CALS and Open Secrets have been informed that authorities in Belgium and Luxembourg are refusing to investigate these economic crimes. With no clear reason for their refusal to engage with our complaint, and after providing a response nine months late, we are forced to question the independence and effectiveness of these mechanisms.

Open Secrets and the Centre for Applied Legal Studies (CALS) share a common goal of holding businesses accountable for their complicity in crimes against humanity. We believe that those who support and profit from the human rights abuses perpetrated under unjust systems like apartheid should be brought to justice and held accountable for their crimes.

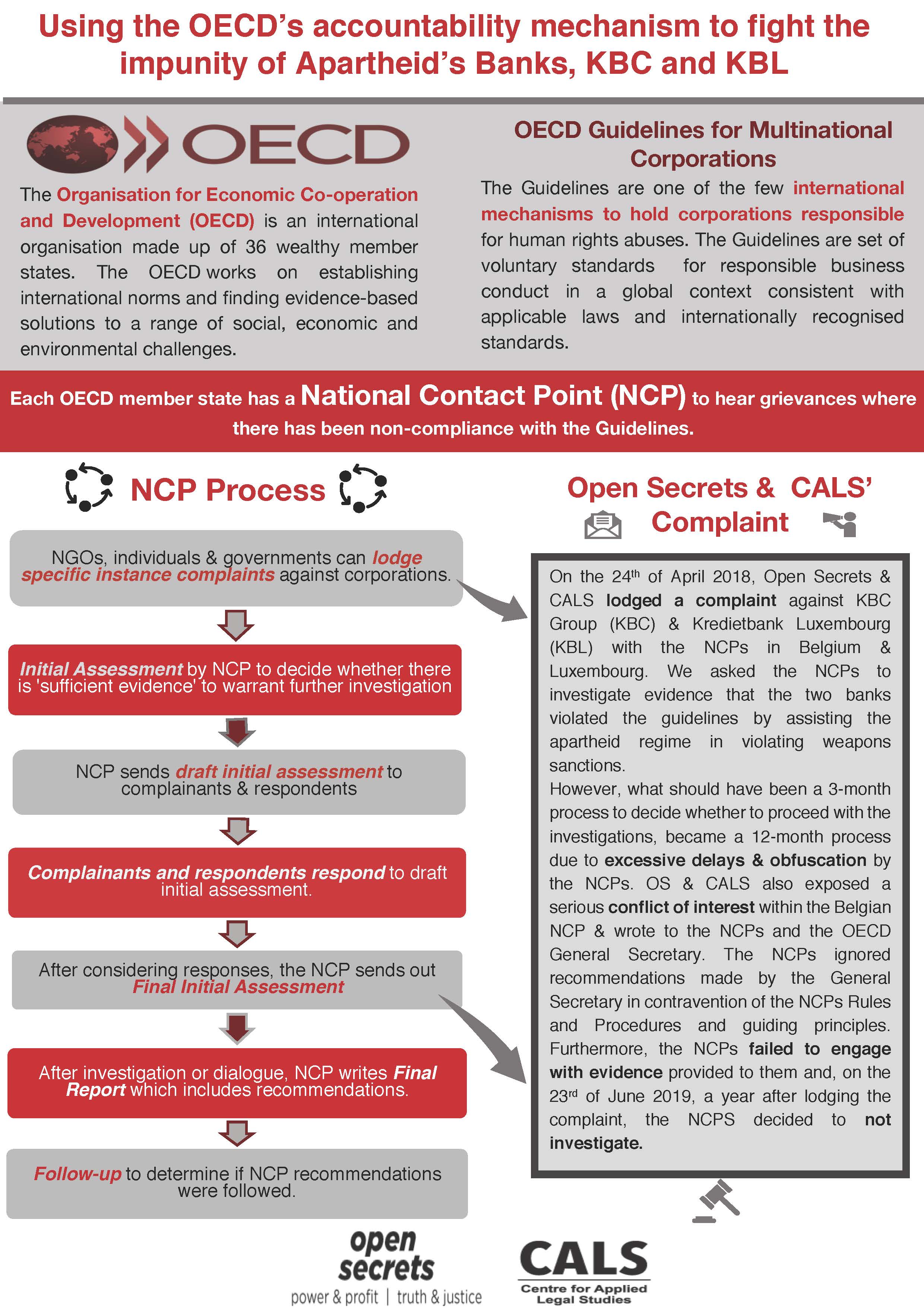

Because of this, in April 2018, CALS and Open Secrets laid a complaint with the Organisation for Economic Co-operation and Development or OECD. The OECD is one of the only mechanisms available worldwide for holding businesses accountable for their roles in human rights abuses. Member countries around the world have national contact points which are intended to ensure multi-national corporations based in their countries comply with the business operations and accountability standards in the OECD’s Guidelines – and to investigate when they do not.

Our complaint provided detailed evidence gathered by Open Secrets, including opinions from leading experts in the financial sector, against two European banks responsible for sustaining and strengthening the system of apartheid. Belgium’s Kredietbank (now known as KBC Group) and its sister bank in Luxembourg (now known as KBL) are responsible for facilitating ilicit money flows that allowed the apartheid regime to secretly buy weapons despite mandatory arms sanctions introduced by the United Nations in the 1970s and 1980s.

These weapons were essential in enabling domestic repression, the apartheid state’s wars and attempts to destablise other governments and liberation movements in southern Africa. Not only was the banks’ assistance vital to keeping the apartheid government in power, but they also profited from these transactions – building their companies on the suffering of millions of people. Apartheid was not only evil in practice, but has been declared a crime against humanity by the United Nations.

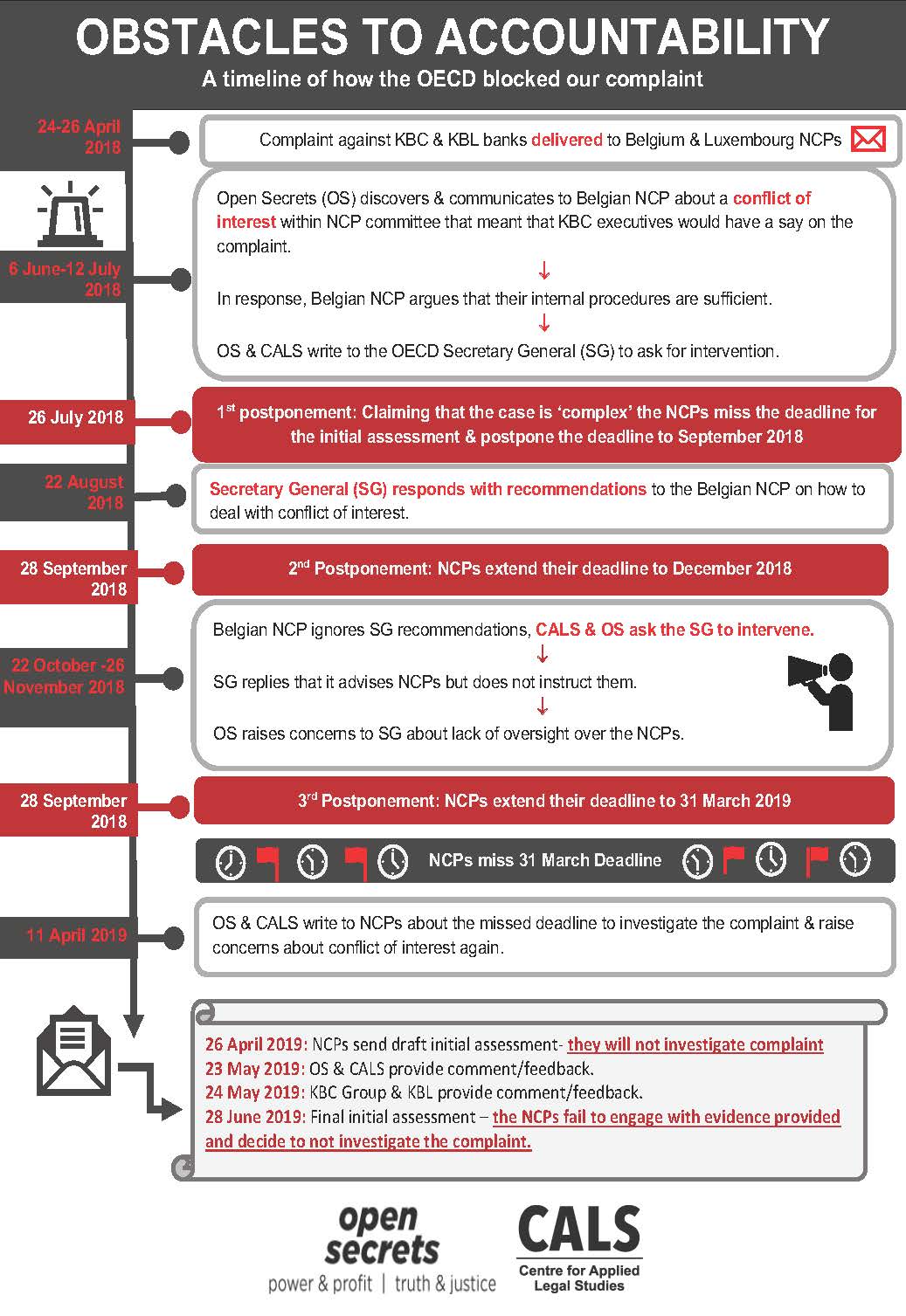

The OECD’s national contact points in Belgium and Luxembourg have, however, shown little interest in these crimes. Despite their rules and procedures stating that they should respond within three months as to whether or not they would investigate the banks’ conduct, they took over a year.

The process was also undermined by a conflict of interest that was dealt with in a manner contrary to the OECD’s own guidelines, as well as the OECD Secretary General’s recommendations. The conflict of interest arose because the Belgian contact point’s committee which was deciding whether or not the complaint would be heard, included business federations with senior representatives from KBC. In other words, KBC was on the committee deciding whether or not a complaint against them would be investigated. When CALS and Open Secrets exposed this serious conflict of interest within the Belgian contact point, nothing was done to address it.

We have now received final reports from both contact points which, unsurprisingly, decline to investigate the complaint. Neither response has engaged meaningfully with the evidence presented to them, the conflict of interest that they were alerted to, or our extensive and detailed response urging them to consider our evidence or expert opinions. In addition, the national contact points chose to disregard the amicus submission by UN Independent Expert, Juan Pablo Bohoslavsky, who emphasised that the banks may be guilty of crimes under international law.

We have today written to the Secretary General of the OECD in Paris again about the conduct of the contact points and their refusal to follow their own guidelines. We fear that the refusal by authorities in Belgium to deal with the conflict of interest threatens public trust in the process and suggests poor governance standards that could enable the cover up of human rights violations. We are committed to holding the banks, and the OECD, accountable for their actions. More broadly, we will continue to advocate for the redress of economic crimes in our work by incorporating what we have learnt through this experience.

“We remain deeply concerned about the flaws that have been exposed in this process. If the OECD is one of the only mechanisms in the world for holding businesses accountable for human rights violations, we may as well say there is no mechanism in place. This is exactly why we need a binding instrument governing business practices internationally,” says Tumelo Matlwa.

“There is no good reason for such a point blank refusal to acknowledge the banks’ conduct merits further investigation. Given the insistence on defending the corporations and ignoring the conflict of interest, the only logical conclusion to draw is that the OECD is compromised. The action of the OECD has favoured powerful banks and seeks to silence evidence of the human rights abuses they are implicated in,” says Tabitha Paine.

OECD Watch, a global network of civil society organisations, has also expressed its disappointment with this process. “Stakeholder confidence is the one of the most important measures of an NCP's effectiveness. We are deeply disappointed that civil society's concerns over conflicts of interest in this case have not been satisfactorily addressed. We continue to believe strongly that NCPs must be structured as independent offices or with representation of all stakeholder groups in their governance. Similarly, we urge NCPs currently lacking a procedural appeal process to establish one to enable redress of procedural problems in NCPs' handling of cases,” says Marian Ingrams.

Read the full complaint to the OECD here or find out more about it here.

For inquiries, please contact:

- Hennie van Vuuren, Director at Open Secrets, on 082 902 1303 or at hvanvuuren@opensecrets.org.za

- Tabitha Paine, Legal Researcher at Open Secrets, on 021 447 2701 / 076 118 1332 or at tpaine@opensecrets.org.za

- Tumelo Matlwa, Attorney at CALS, on 011 717 8616 / 082 236 9058 or at tumelo.matlwa@wits.ac.za